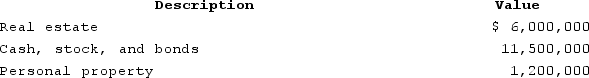

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $1,825,000 mortgage and Nathan made taxable gifts in 2009 totaling $3.0 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $3.0 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

The real estate is subject to a $1,825,000 mortgage and Nathan made taxable gifts in 2009 totaling $3.0 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $3.0 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

Definitions:

Habeas Corpus

A legal principle that seeks to protect individuals from unlawful detention, allowing detainees to challenge the legality of their detention.

Psychotropic Medications

Drugs that mainly affect the brain and reduce many symptoms of mental dysfunction.

State Mental Hospital

A publicly funded hospital specializing in treating individuals with mental health disorders, offering various therapies and supports.

Right to Refuse Treatment

The legal right of a patient to decline medical or psychological treatment after understanding the potential risks and benefits.

Q26: Russell Starling, an Australian citizen and resident,

Q37: Which of the following is not an

Q46: Luther was very excited to hear about

Q58: The relationship requirement for qualifying relative includes

Q63: Tennis Pro has the following sales, payroll,

Q69: Assume that Clampett, Incorporated, has $200,000 of

Q71: Assume that Javier is indifferent between investing

Q74: Unlikein partnerships, adjustments that decrease an S

Q116: Which of the following statements is false

Q137: Which of the following is not a