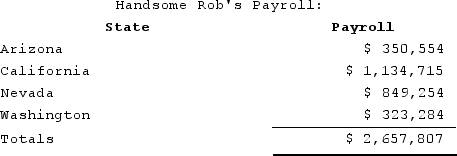

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob hasincome tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $201,400 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

Definitions:

Learning Associations

The process by which an individual learns to link two stimuli or a behavior and its consequence, forming new knowledge.

Spontaneous Recovery

A phenomenon in which a previously extinguished response re-emerges after a period of no exposure to the conditioned stimulus.

Observational Learning

Learning that occurs through observing the behaviors of others and the outcomes of those behaviors, without direct instruction.

Associative Learning

Learning that certain events occur together. The events may be two stimuli (as in classical conditioning) or a response and its consequences (as in operant conditioning).

Q12: Giselle is a citizen and resident of

Q36: Under most U.S. treaties, a resident of

Q70: Kathy is a 25percent partner in the

Q76: Reno Corporation, a U.S. corporation, reported total

Q89: A gross receipts tax is subject to

Q100: Absent a treaty provision, what is the

Q104: A state's apportionment formula divides nonbusiness income

Q107: Gerald received a one-third capital and profit

Q118: Giving samples and promotional materials without charge

Q122: Roxy operates a dress shop in Arlington,