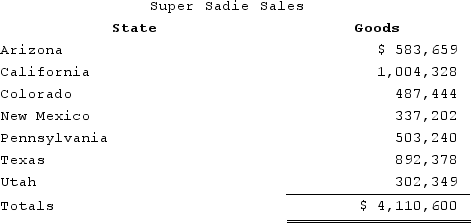

Super Sadie, Incorporated, manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Definitions:

Optimal Output

The level of production that maximizes a firm's profit, where marginal revenue equals marginal cost.

Producer Surplus

Producer surplus is the difference between what producers are willing to accept for a good or service versus what they actually receive, reflecting gains from trade.

Economic Rents

Earnings from a factor of production in excess of what is necessary to keep the factor in its current use, often due to limited supply or unique qualities.

Competitive Market

A market structure characterized by many buyers and sellers where no single participant has market power to influence prices significantly.

Q14: Katrina is a one-third partner in the

Q15: The regulation with the lowest authoritative weight

Q24: Kathy is a 25percent partner in the

Q26: The Wayfair decision reversed the Quill decision,

Q32: Which requirement must be satisfied in order

Q36: Which types of penalties are only imposed

Q56: Which of the following isn't a typical

Q59: On which of the following transactions should

Q89: In addition to raising revenues, specific U.S.

Q103: Rainier Corporation, a U.S. corporation, manufactures and