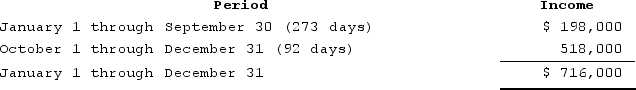

CB Corporation was formed as a calendar-year S corporation. Casey is a 60percent shareholder and Bryant is a 40percent shareholder. On September 30, 2020, Bryant sold his CB shares to Don. CB reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

How much 2020 income is allocated to each shareholder if CB uses its normal accounting rules to allocate income to the specific periods in which it was actually earned?

How much 2020 income is allocated to each shareholder if CB uses its normal accounting rules to allocate income to the specific periods in which it was actually earned?

Definitions:

Collateral

An asset pledged as security for the repayment of a loan, forfeitable in the event of a default.

Financing Statement

A document filed to give public notice that a creditor has a security interest in the debtor's collateral, used in securing transactions.

Attach

in legal terms, means to legally seize a person's property to secure or satisfy a court judgement.

Enforceable Security Interest

A legal claim or lien on collateral that gives a creditor the right to take possession of the property if the debtor defaults on obligations.

Q3: The trade show rule allows businesses to

Q39: A flat tax is an example of

Q43: A serial gift strategy consists of arranging

Q73: Tyson, a one-quarter partner in the TF

Q78: Which of the following statements best describes

Q82: Carmello is a one-third partner in the

Q111: Most services are sourced to the state

Q122: On March 15, 20X9, Troy, Peter, and

Q123: The main difficulty in calculating an income

Q132: Most states have shifted away from an