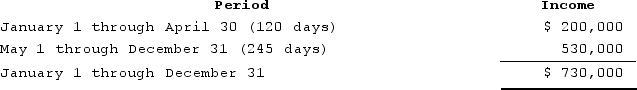

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020?

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020?

Definitions:

Hormones

Chemical substances produced by glands in the body that regulate the activity of certain cells or organs.

Bloodstream

The flowing body fluid that circulates throughout the body via the circulatory system, carrying oxygen, nutrients, and hormones to various tissues and removing carbon dioxide and other wastes.

Psychological Influences

Factors that affect mental processes and behavior, including emotions, attitudes, thoughts, and social dynamics.

Endocrine System

A collection of glands that produce hormones regulating metabolism, growth and development, tissue function, sexual function, reproduction, sleep, and mood, among other things.

Q8: John, a limited partner of Candy Apple,

Q17: Hanover Corporation, a U.S. corporation, incurred $354,000

Q25: Which of the following transactions engaged in

Q28: One must considerthe "economy" criterion in evaluating

Q41: Jenny has a $54,000 basis in her

Q70: All of the following are false regarding

Q83: Bobby T (95percent owner)would like to elect

Q96: Nelson has the choice between investing in

Q117: The Wrigley case held that the sale

Q134: Which of the following is true regarding