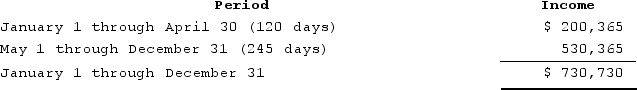

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020?

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020?

Definitions:

International Monetary Reserves

International monetary reserves are assets held by central banks or monetary authorities in various forms, such as foreign currencies, gold, and Special Drawing Rights (SDRs), used to back the currency and support economic policies.

Domestic Macroeconomic Adjustments

Changes made within a country's economy to address macroeconomic issues such as inflation, unemployment, and economic growth.

Foreign-exchange Reserves

Assets held by a central bank in foreign currencies, which are used to back liabilities on their own issued currency as well as to influence monetary policy.

Pegged Exchange Rate

A currency system where a country's currency value is fixed or linked to another currency or a basket of currencies.

Q22: A non-U.S. citizen with a green card

Q46: Hilary had an outside basis in LTL

Q51: A common example of an employment-related tax

Q79: M Corporation assumes a $200 liability attached

Q80: Tennis Pro has the following sales, payroll,

Q93: Assume Joe Harry sells his 25percent interest

Q102: The effective tax rate, in general, provides

Q112: The concept of tax sufficiency:<br>A)suggests the need

Q121: An S election is terminated if the

Q126: Sue and Andrew form SA general partnership.