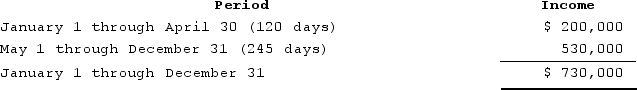

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Definitions:

Paralanguage

Non-verbal elements of communication used to convey emphasis or emotion, such as tone of voice or gesture.

Body Language

Non-verbal communication through physical behaviors, such as gestures, postures, and expressions, which can convey emotions and intentions.

Nonverbal Communication

A form of communication that involves the transmission of messages without the use of words, such as gestures, facial expressions, and body language.

Body Language

Non-verbal communication through physical behaviors such as gestures, posture, and facial expressions.

Q3: Which of the following is a requirement

Q32: Riley is a 50percent partner in the

Q48: Which of the following statements best describes

Q57: A hybrid entity established in Ireland is

Q66: Philippe is a French citizen. During 2020

Q73: Which of the following statements regarding the

Q96: Nelson has the choice between investing in

Q107: Which of the following statements is correct

Q118: This year Don and his son purchased

Q127: Al believes that SUVs have negative social