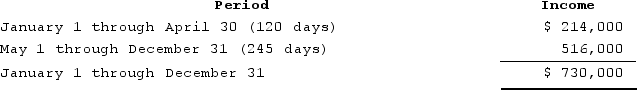

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Definitions:

Unsaturated Fatty Acid

A type of fatty acid with one or more double bonds in the hydrocarbon chain, which can affect the fluidity of cell membranes.

Triglyceride

A type of fat or lipid found in blood, formed from one molecule of glycerol and three fatty acids.

Micelle

An aggregate of surfactant molecules dispersed in a liquid colloid, forming a structure with hydrophobic tails in the center and hydrophilic heads on the outside.

Carbon-carbon Double Bond

A strong chemical bond involving the sharing of two pairs of electrons between two carbon atoms, characterized by its reactivity and presence in unsaturated compounds.

Q20: Mandel transferred property to his new corporation

Q43: Daniela is a 25percent partner in the

Q55: Erica and Brett decide to form their

Q55: Bethesda Corporation is unprotected from income tax

Q59: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q65: Tennis Pro has the following sales, payroll,

Q66: Which of the following statements best describes

Q73: Assume Joe Harry sells his 25percent interest

Q75: Gerald received a one-third capital and profit

Q114: Casey transfers property with a tax basis