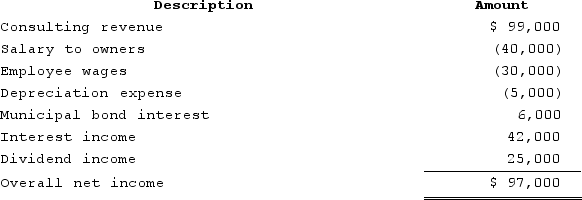

RGD Corporation was a C corporation from its inception in 2015 through 2019. However, it elected S corporation status effective January 1, 2020. RGD had $50,000 of earnings and profits at the end of 2019. RGD reported the following information for its 2020 tax year.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

Definitions:

Overcontrolled/Constrictive

Personality characteristics involving excessive restraint, control over impulses, and avoidance of risks or spontaneity.

Neuroticism

A personality trait characterized by the tendency to experience negative emotions, such as anxiety, depression, or anger, more frequently and intensely than others.

Conscientiousness

A personality trait that reflects a person's tendency to be organized, dependable, and show self-discipline and a goal-directed behavior.

Low Body Weight

Refers to a body weight that is significantly below what is considered normal or healthy for a person's height and age.

Q3: Which of the following statements is (are)true

Q11: Curtis invests $250,000 in a city of

Q15: Tone Loc and 89 of his biggest

Q21: Eric has $5 million of property that

Q82: Carmello is a one-third partner in the

Q90: Differences in voting powers are permissible across

Q90: In the sale of a partnership interest,

Q91: Antoine transfers property with a tax basis

Q105: The two components of the tax calculation

Q139: Business income includes all income earned in