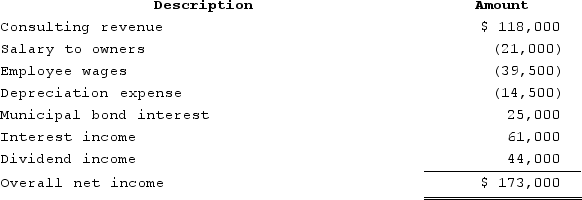

RGD Corporation was a C corporation from its inception in 2015 through 2019. However, it elected S corporation status effective January 1, 2020. RGD had $69,000 of earnings and profits at the end of 2019. RGD reported the following information for its 2020 tax year.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

Definitions:

Perfectly Competitive

A theoretical market structure characterized by infinite buyers and sellers, homogeneous products, and free entry and exit, leading to optimal output levels and no individual control over prices.

Monopolistic

Pertaining to a market structure characterized by a single seller who has significant control over the market and prices.

Monopolistically Competitive

A market structure characterized by many firms selling similar but not identical products, allowing for some degree of market power and product differentiation.

Five Forces Model

A model developed by Michael Porter that helps us understand the five competitive forces that determine the level of competition and profitability in an industry.

Q10: Simone transferred 100 percent of her stock

Q10: Tracey is unmarried and owns $17 million

Q37: Partnerships can request up to a six-month

Q42: Separately stated items are tax items that

Q43: Natsumi is a citizen and resident of

Q46: Alex, a U.S. citizen, became a resident

Q66: At the beginning of the year, Clampett,

Q69: The VRX Partnership (a calendar year-end entity)has

Q73: Super Sadie, Incorporated, manufactures sandals and distributes

Q103: Red Blossom Corporation transferred its 40 percent