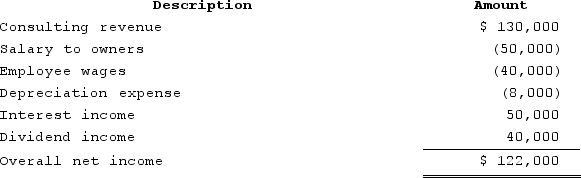

RGD Corporation was a C corporation from its inception in 2016 through 2019. However, it elected S corporation status effective January 1, 2020. RGD had $50,000 of earnings and profits at the end of 2019. RGD reported the following information for its 2020 tax year.

What amount of excess net passive income tax is RGD liable for in 2020? (Round your answer for excess net passive income to the nearest thousand.)

What amount of excess net passive income tax is RGD liable for in 2020? (Round your answer for excess net passive income to the nearest thousand.)

Definitions:

Conquistadors

Conquistadors were the Spanish soldiers, explorers, and fortune hunters who took part in the conquest of the Americas in the 16th century, leading to the extensive territorial expansions of Spain.

Missionaries

Individuals sent on a religious mission, often to promote their faith in foreign countries.

Schemas

Cognitive structures that help individuals organize and interpret information, based on prior knowledge and experiences.

Gender Expressions

The external manifestations of an individual's gender identity, including clothing, hairstyle, behavior, and other forms of presentation.

Q8: Which of the following statements regarding hot

Q24: Greg, a 40percent partner in GSS Partnership,

Q47: Ypsi Corporation has a precredit U.S. tax

Q57: Antoine transfers property with a tax basis

Q62: XYZ Corporation (an S corporation)is owned by

Q67: Rachelle transfers property with a tax basis

Q104: Shea, an individual, is a 100percent owner

Q110: At his death Tyrone's life insurance policy

Q120: Which of the following statements does not

Q126: Sue and Andrew form SA general partnership.