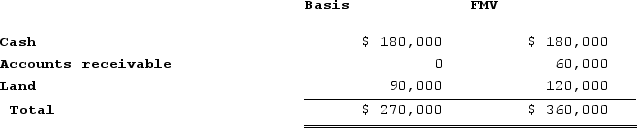

The SSC, a cash-method partnership, has a balance sheetthat includes the following assets on December 31 of the current year:  Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Definitions:

Customized Bikes

Bicycles that are tailored or modified according to the personal preferences, specifications, or requirements of an individual.

Choiceboard

An interactive online system that allows consumers to customize the features or attributes of a product or service they intend to purchase.

Reebok Design

Refers to the distinctive aesthetic and functional elements in footwear and apparel produced by the athletic brand Reebok.

Athletic Shoes

Footwear designed specifically for sports and physical activities, offering varying levels of support, performance, and durability.

Q12: The recipient of a tax-free stock distribution

Q15: Jay has a tax basis of $14,000

Q16: A rectangle with a triangle within it

Q30: Roxy operates a dress shop in Arlington,

Q49: On April 18, 20X8, Robert sold his

Q52: Which statement best describes the U.S. framework

Q90: Which of the following statements best describes

Q93: Milton and Rocco are having a heated

Q100: Don and Marie formed Paper Lilies Corporation

Q113: Any losses that exceed the tax basis