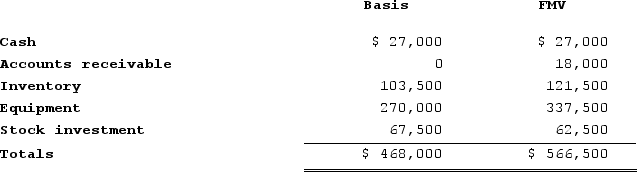

The VRX Partnership (a calendar year-end entity)has the following assets and no liabilities:

The equipment was purchased for $360,000 and VRX has taken $90,000 of depreciation. The stock was purchased seven years ago. What are VRX's hot assets for purposes of a sale of partnership interest?

The equipment was purchased for $360,000 and VRX has taken $90,000 of depreciation. The stock was purchased seven years ago. What are VRX's hot assets for purposes of a sale of partnership interest?

Definitions:

Applicant Tracking System

Software used by employers to manage job applications and streamline the hiring process.

Recruitment Statistics

Data and metrics related to the process of attracting, selecting, and appointing suitable candidates for jobs within an organization.

Outplacement Services

Support services provided by companies to help terminated employees transition to new jobs, including resume writing and interview training.

Terminated Employees

Individuals whose employment contracts have been ended by their employers due to various reasons such as layoffs, misconduct, or organizational changes.

Q3: Which of the following foreign taxes is

Q19: Federal/state adjustments correct for differences between two

Q27: Clampett, Incorporated, has been an S corporation

Q29: The least aggregate deferral test uses the

Q41: Jenny has a $54,000 basis in her

Q58: The payroll factor includes payments to independent

Q77: Maria resides in San Antonio, Texas. She

Q83: Bobby T (95percent owner)would like to elect

Q104: Under what conditions will a partner recognize

Q121: Which of the following is incorrect regarding