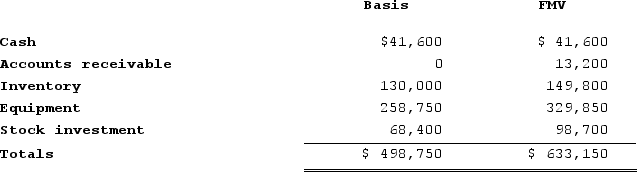

Victor is a one-third partner in the VRX Partnership, with an outside basis of $166,900 on January 1. Victor sells his partnership interest to Raj on January 1 for $212,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1: (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)

The equipment was purchased for $345,000 and the partnership has taken $86,250 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $345,000 and the partnership has taken $86,250 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

The Passion Of The Christ

A 2004 film directed by Mel Gibson depicting the final hours and crucifixion of Jesus Christ, noted for its graphic portrayal of violence and its emotional depth.

Cannes

An international film festival held annually in Cannes, France, known for showcasing new films of all genres, including documentaries, from around the world.

The Beguiled

A film that has seen two prominent adaptations (1971 and 2017), revolving around an injured Union soldier who finds himself on the premises of a Southern girls' boarding school, leading to jealousy and betrayal.

Presold

A marketing strategy wherein a product or content is sold or licensed before it is actually available to the public, commonly used in the publishing and film industries.

Q15: Which of the following persons should not

Q25: Which of the following does not represent

Q35: Gordon operates the Tennis Pro Shop in

Q38: Gabriel had a taxable estate of $16

Q65: Wonder Corporation declared a common stock distribution

Q67: A partner can generally apply passive activity

Q68: Julian transferred 100 percent of his stock

Q77: A §754 election is made by a

Q82: In which of the following state cases

Q110: On January 1, X9, Gerald received his