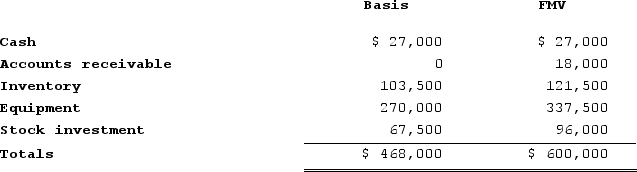

Zayde is a one-third partner in the ARZ Partnership, with an outside basis of $156,000 on January 1. Zayde sells his partnership interest to Thomas on January 1 for $180,000 cash. The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Definitions:

Additional Taxes

Taxes levied in addition to the standard or existing taxes, usually aimed at raising extra revenue for specific purposes.

NASW Code of Ethics

The NASW Code of Ethics is a set of principles and standards that guide the professional conduct of social workers, developed by the National Association of Social Workers.

Policy Advocacy

Efforts to influence public policy through various forms of persuasion, lobbying, or public engagement.

Competitive Strategies

Approaches adopted by organizations or individuals to outperform their rivals by creating advantageous conditions or leveraging unique capabilities.

Q23: Tennis Pro is headquartered in Virginia. Assume

Q30: Jackson has the choice to invest in

Q40: Sami transferred property with a fair market

Q47: Moss Incorporated is a Washington corporation. It

Q52: Harry and Sally formed Empire Corporation on

Q52: Which of the following statements is true?<br>A)Municipal

Q66: Which of the following statements best describes

Q82: Siblings are considered "family" under the stock

Q85: Gordon operates the Tennis Pro Shop in

Q105: Lansing Company is owned equally by Jennifer,