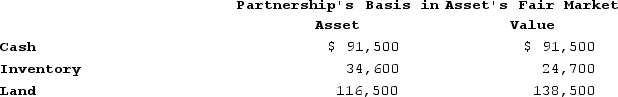

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $18,600. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Demographic Groups

Categories of populations defined by characteristics such as age, gender, ethnicity, or income.

American Work Life

The characteristics and culture surrounding employment and labor in the United States, including norms, behaviors, and expectations.

Unions

Organizations formed by workers to protect their rights and interests, often engaging in collective bargaining and labor negotiations with employers.

Social Movements

Collective efforts by groups of people to drive or resist changes in society, often aiming to address issues of social justice or political reform.

Q1: Roxy operates a dress shop in Arlington,

Q19: Under the entity concept, a partnership interest

Q27: A U.S. corporation reports its foreign tax

Q59: XYZ Corporation (an S corporation)is owned by

Q61: Portland Corporation is a U.S. corporation engaged

Q80: Tennis Pro has the following sales, payroll,

Q83: Jerry, a partner with 30percent capital and

Q87: In which type of distribution may a

Q93: Orono Corporation manufactured inventory in the United

Q104: Phillip incorporated his sole proprietorship by transferring