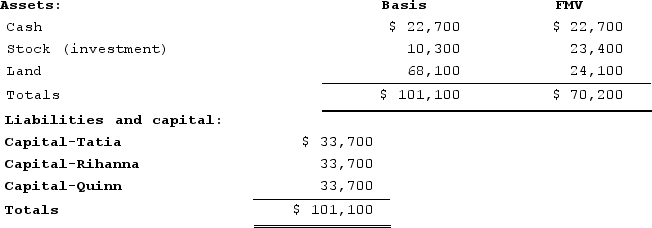

Tatia's basis in her TRQ Partnership interest is $33,700. Tatia receives a distribution of $24,100 cash from TRQ in complete liquidation of her interest. The three partners in TRQ share profits, losses, and capital equally. TRQ has the following balance sheet:

a. What is the amount and character of Tatia's recognized gain or loss? What is the effect on the partnership assets?

a. What is the amount and character of Tatia's recognized gain or loss? What is the effect on the partnership assets?

b. If TRQ has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment?

Definitions:

Sherman Act

A landmark federal statute in the field of U.S. antitrust law passed in 1890 to protect competition and prohibit monopolistic practices.

Clayton Act

A U.S. antitrust law, enacted in 1914, aimed at promoting competition and preventing unfair business practices.

Competitive Firms

Companies that operate in a market structure characterized by a large number of sellers producing similar but slightly differentiated products, where no single seller has significant market power to determine prices.

Clayton Act

A United States antitrust law, enacted in 1914, designed to prevent anticompetitive practices and monopolies, enhancing the Sherman Antitrust Act.

Q15: Which of the following persons should not

Q26: The shareholders in the target corporation always

Q29: Which of the following is not a

Q46: Madison Corporation reported taxable income of $400,000

Q50: Junior earns $80,000 taxable income as a

Q91: Which of the following does not adjust

Q92: S corporation shareholders are not allowed to

Q101: Victor is a one-third partner in the

Q109: Sunapee Corporation reported taxable income of $700,000

Q120: Which of the following statements does not