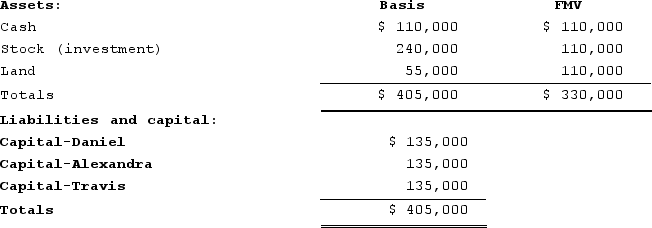

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Ecological Code of Ethics

A set of principles and guidelines aimed at promoting environmentally responsible behaviors and practices among individuals and organizations.

Triple-Top Line Marketing

An approach to marketing that focuses on social, environmental, and economic benefits, encouraging businesses to measure success not just by financial gain but also by their positive impact on the world.

Triple Bottom Line

A framework or accounting principle that goes beyond the traditional measures of profits, assessing an organization's performance in terms of its environmental, social, and financial impacts.

Sustainable, Long-Term Growth

Economic growth and business expansion that are maintained over time without depleting resources or harming the environment.

Q14: Vanessa contributed $20,000 of cash and land

Q25: Which of the following does not represent

Q60: Which of the following would not be

Q61: XYZ, LLC, has several individual and corporate

Q77: A §754 election is made by a

Q81: The SSC, a cash-method partnership, has a

Q99: Jesse Stone is a citizen and bona

Q102: A unitary-return group includes only companies included

Q111: Employers often withhold federal income taxes directly

Q125: Supposethat at the beginning of 2020 Jamaal's