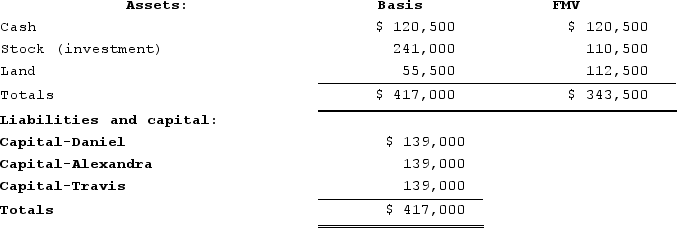

Daniel's basis in the DAT Partnership is $139,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Muscle Weakness

A reduction in the strength of one or more muscles, which can affect the ability to move and perform daily activities.

Hemostasis Phase

The first stage of wound healing, when the body acts to stop bleeding through clot formation and blood vessel constriction.

Deep Laceration

A severe cut or tear in the skin or flesh that is often deeper than it is wide, requiring professional medical attention.

Ototoxicity

The property of being toxic to the ear, specifically the cochlea or auditory nerve and sometimes the vestibular system, leading to hearing loss or imbalance.

Q33: Assume Tennis Pro discovered that one salesperson

Q35: Gordon operates the Tennis Pro Shop in

Q51: Evergreen Corporation distributes land with a fair

Q53: Husker Corporation reportsa deficit in current E&P

Q85: A partner's self-employment earnings (loss)may be affected

Q108: To make an S election effective as

Q110: Raquel recently overheard two journalism students discussing

Q117: The requirements for tax deferral in a

Q133: The specific identification method and monthly allocation

Q153: Like partnerships, S corporations generally determine their