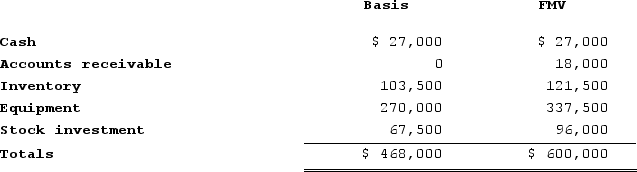

Victor is a one-third partner in the VRX Partnership, with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1 for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Non-Controlling Interest (NCI)

The portion of equity in a subsidiary not owned by the parent company, representing minority shareholders' interest.

Full Fair Value

An approach within certain valuation and accounting frameworks where assets and liabilities are recorded at their full market value.

Proportionate Consolidation Method

An accounting method where an investing entity records its share of the assets, liabilities, income, and expenses of an associate or joint venture.

Assets and Liabilities

Assets are resources owned by a company expected to provide future benefits, and liabilities are obligations a company owes to outside parties.

Q16: In a proportional (flat)tax rate system, the

Q22: The Mobil decision identified three factors to

Q38: Which of the following is an income-based

Q40: Which of the following is not considered

Q49: On April 18, 20X8, Robert sold his

Q81: A §338 transaction is a stock acquisition

Q89: Evergreen Corporation distributes land with a fair

Q98: The city of Granby, Colorado, recently enacted

Q113: Roxy operates a dress shop in Arlington,

Q156: Regarding debt, S corporation shareholders are deemed