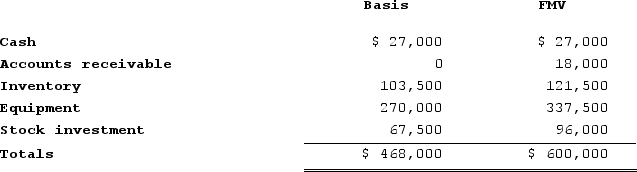

Zayde is a one-third partner in the ARZ Partnership, with an outside basis of $156,000 on January 1. Zayde sells his partnership interest to Thomas on January 1 for $180,000 cash. The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased three years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Definitions:

Financial Advantage

The benefit or profit derived from financial actions or decisions, such as investments or loans.

Dropping Product

A decision made by a company to stop producing or selling a particular product due to factors like low sales, reduced profit margins, or strategic realignment.

Fixed Manufacturing Expenses

represent the costs that do not vary with the level of production output, such as rent, salaries of permanent staff, and depreciation of factory equipment.

Financial Advantage

A benefit in monetary terms that gives an individual, company, or situation a superior position compared to others.

Q5: Congress recently approved a new, smaller budget

Q12: The recipient of a tax-free stock distribution

Q34: This year, Reggie's distributive share from Almonte

Q47: Ricky and Lucy are debating several types

Q51: Which of the following items of foreign

Q68: Assume that Clampett, Incorporated, has $200,000 of

Q76: Wyoming imposes an income tax on corporations.

Q98: How does additional debt or relief of

Q105: Boomerang Corporation, a New Zealand corporation, is

Q109: April transferred 100 percent of her stock