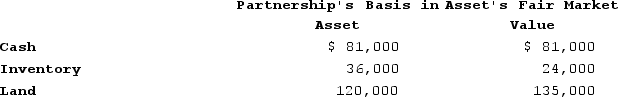

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Tourism

The activity of traveling to and staying in places outside one's usual environment for leisure, business, or other purposes.

US Exports

Goods, services, or commodities sent from the United States to other countries for sale or trade.

Exchange Rate

The exchange rate is the price at which one currency can be exchanged for another, influencing international trade and investments.

US Dollars

A form of currency recognized and utilized worldwide, characterized by its representation of the American economy.

Q3: The definition of property as it relates

Q7: Interest and dividends are allocated to the

Q18: S corporation losses allocated to a shareholderthat

Q20: Frank and Bob are equal members in

Q35: Property taxes may be imposed on both

Q40: Which of the following is not considered

Q71: What is the rationale for the specific

Q75: Terrapin Corporation incurs federal income taxes of

Q108: Red Blossom Corporation transferred its 40 percent

Q128: In Complete Auto Transit the U.S. Supreme