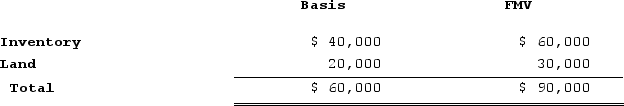

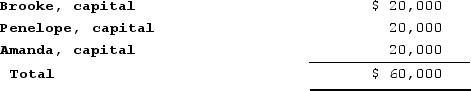

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Average Fixed Cost

The total fixed costs of production divided by the quantity of output produced.

Marginal Cost

The change in total production cost that arises when the quantity produced is incremented by one unit.

Average Total Cost

The total cost of production divided by the number of units produced, which includes both fixed and variable costs.

Average Total Cost

The total cost divided by the number of goods or services produced, representing the per unit cost of production.

Q12: If an S corporation never operated as

Q28: Guaranteed payments are included in the calculation

Q40: Jimmy Johnson, a U.S. citizen, is employed

Q51: Clampett, Incorporated, converted to an S corporation

Q68: Leonardo, who is married but files separately,

Q69: Curtis invests $500,000 in a city of

Q102: Comet Company is owned equally by Pat

Q108: On January 1, 20X9, Mr. Blue and

Q118: Esther and Elizabeth are equal partners in

Q129: Vanessa is the sole shareholder of V