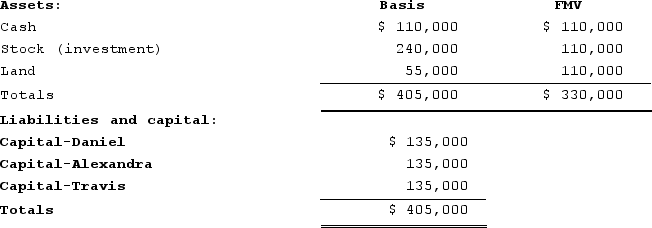

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Corm

A rounded underground storage organ consisting of swollen stem tissue, covered with scaly leaves, found in some plants serving for food storage and to survive winter or dry months.

Fields

Specific areas in databases or software forms where data is inserted or displayed, often categorized by the type of data they hold.

Records

Documents or files that preserve information or evidence of events, transactions, or processes.

Tables

Structures in databases or spreadsheets that organize data into rows and columns for easy reference and manipulation.

Q3: Which of the following foreign taxes is

Q14: Before subpart F applies, a foreign corporation

Q15: Which of the following persons should not

Q47: Mike and Michelle decided to liquidate their

Q50: Lola is a 35percent partner in the

Q69: Curtis invests $500,000 in a city of

Q82: Siblings are considered "family" under the stock

Q94: Horton Corporation is a 100 percent owned

Q125: Kim received a one-third profits and capital

Q140: Which of the following income items from