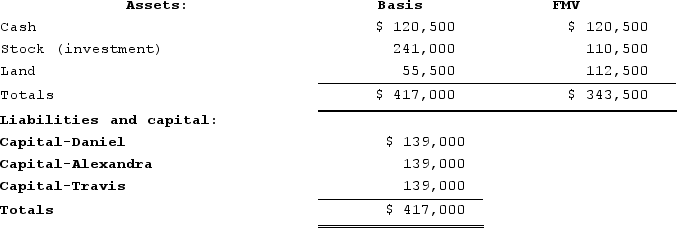

Daniel's basis in the DAT Partnership is $139,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Q18: S corporation losses allocated to a shareholderthat

Q31: Partnerships may maintain their capital accounts according

Q34: Clampett, Incorporated, has been an S corporation

Q35: Gordon operates the Tennis Pro Shop in

Q75: Gerald received a one-third capital and profit

Q98: Jaime has a basis in her partnership

Q98: The city of Granby, Colorado, recently enacted

Q105: Boomerang Corporation, a New Zealand corporation, is

Q128: Relative to explicit taxes, implicit taxes are

Q153: Like partnerships, S corporations generally determine their