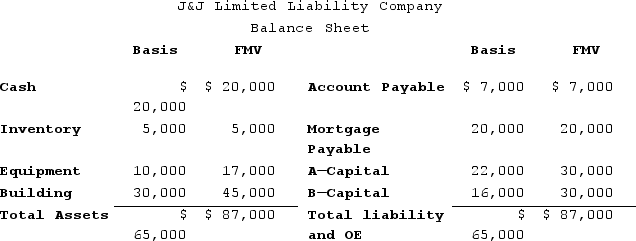

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Direct Manufacturing Cost

Expenses directly related to the production of goods, including labor and materials.

Incremental Manufacturing Cost

The extra expense associated with manufacturing an additional unit of a product.

Contribution Margin

The amount remaining from sales revenue after variable expenses are subtracted, contributing towards covering fixed costs and profit.

Variable Selling Expenses

Costs that fluctuate with the level of sales, such as commissions or shipping fees.

Q40: Partnership tax rules incorporate both the entity

Q43: Geronimo files his tax return as a

Q51: Gordon operates the Tennis Pro Shop in

Q62: The sales and use tax base varies

Q81: Robinson Company had a net deferred tax

Q88: Marty is a 40percent owner of MB

Q91: General Inertia Corporation made a distribution of

Q95: Jonah, a single taxpayer, earns $152,400 in

Q107: Which of the following items does not

Q127: The built-in gains tax does not apply