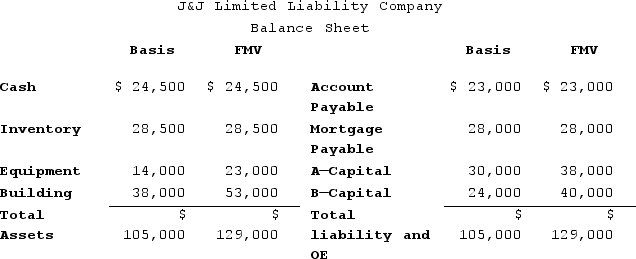

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Recent Mammogram

A modern medical imaging process used to examine breast tissue for any signs of cancer or abnormalities.

General Health

Refers to the overall state and well-being of an individual's physical, mental, and social health, often assessed through various measures and indicators.

Multiple Logistic Regression

A statistical method for predicting a binary outcome from one or more predictor variables.

Sample Proportion

The fraction or percentage of the sample that represents a particular characteristic or outcome.

Q7: Lansing Company is owned equally by Jennifer,

Q11: A taxpayer who receives nonvoting stock is

Q12: Gordon operates the Tennis Pro Shop in

Q26: Barry has a basis in his partnership

Q48: Marc, a single taxpayer, earns $60,000 in

Q58: Which of the following would not result

Q87: Which of the following is considered a

Q95: Jonah, a single taxpayer, earns $152,400 in

Q100: Federico is a 30percent partner in the

Q111: Most services are sourced to the state