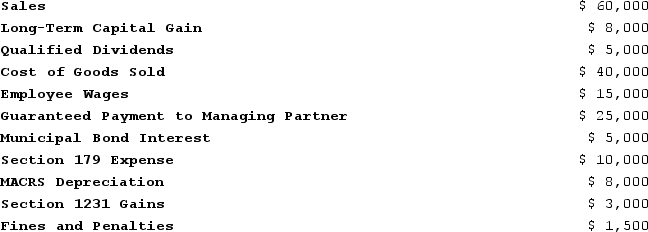

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Definitions:

Communist Agents

Individuals who secretly work on behalf of a communist government or organization to spread communism, gather intelligence, or influence the politics of other nations.

19th Amendment

An amendment to the United States Constitution that granted American women the right to vote, ratified in 1920.

Women's Vote

The right of women to vote in elections, a historic achievement in the struggle for gender equality that was realized in various stages globally throughout the 19th and 20th centuries.

Constitution

The fundamental principles and established precedents according to which a state or other organization is governed.

Q4: Montclair Corporation had current and accumulated E&P

Q31: A sales tax is a common example

Q37: Partnerships can request up to a six-month

Q57: An S corporation can use a noncalendar

Q58: On 12/31/X4, Zoom, LLC, reported a $60,000

Q59: Which of these items is not an

Q70: During 2020, CDE Corporation (an S corporation

Q83: Bobby T (95percent owner)would like to elect

Q95: Jonah, a single taxpayer, earns $152,400 in

Q99: Which of the following is not one