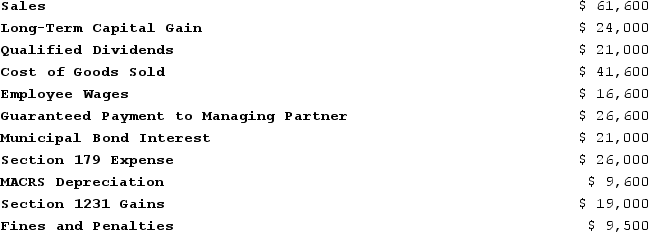

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Definitions:

Negligence Action

A legal suit filed by an individual claiming harm due to another party's failure to exercise an appropriate level of care.

Forfeiture Rule

The principle that a criminal should not be permitted to profit from a crime.

Criminal's Estate

The assets and properties owned by a criminal, which may be subject to legal action or forfeiture in the event of legal proceedings against the individual.

Negligence Action

A legal lawsuit filed when someone suffers harm due to another's failure to take reasonable care.

Q10: The SSC, a cash-method partnership, has a

Q24: Determine if eachof the following is a

Q35: Gordon operates the Tennis Pro Shop in

Q74: On 12/31/X4, Zoom,LLC, reported a $54,000 loss

Q90: In the sale of a partnership interest,

Q97: Assume that at the end of 2020,

Q108: While sales taxes are quite common, currently

Q114: Evaluate the U.S. federal tax system on

Q118: Sam owns 65 percent of the stock

Q151: Assume that at the end of 2020,