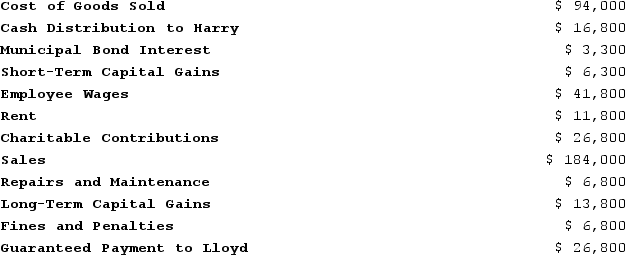

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Definitions:

Sick Role

A sociological concept that describes the rights and obligations of individuals who are ill, including the expectation to seek help and the obligation to strive to get well.

Competent Practitioners

Individuals who possess the required skills, knowledge, and ability to perform their professional duties effectively.

Medicalized

The process by which human conditions and problems come to be defined and treated as medical issues, often involving interventions by health professionals.

Professionalization

The process of becoming a professional; acquiring the skills, knowledge, and standards needed for a profession, often involving formal education and training.

Q2: During 2020, MVC operated as a C

Q5: Sybil transfers property with a tax basis

Q15: Yellowstone Corporation made a distribution of $300,000

Q30: On January 1, X9, Gerald received his

Q52: The "current income tax expense or benefit"

Q54: Tammy owns 60 percent of the stock

Q80: Ruby's tax basis in her partnership interest

Q84: Which of the following items is not

Q108: On January 1, 20X9, Mr. Blue and

Q109: Sunapee Corporation reported taxable income of $700,000