Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

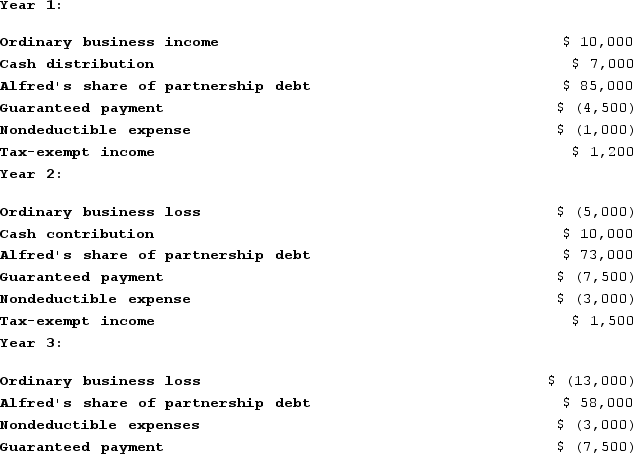

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Bank Fraud Statute

A legal provision aimed at fighting fraudulent activities targeting financial institutions, including deception for financial gain against banks.

Property Rights

are legal rights to possess, use, and dispose of assets or property.

Retribution

A principle of justice where the punishment is proportionate to the crime committed, aiming for moral balance.

Criminal Prosecutions

The process of charging someone with a crime and conducting a trial to determine guilt or innocence.

Q7: Mandy, the mayor of Bogart and a

Q28: One must considerthe "economy" criterion in evaluating

Q35: Viking Corporation is owned equally by Sven

Q41: Implicit taxes are indirect taxes on tax-favored

Q55: Nadine Fimple is a one-half partner in

Q58: On 12/31/X4, Zoom, LLC, reported a $60,000

Q87: If an S corporation shareholder sells her

Q119: In terms of effective tax rates, the

Q122: Goose Company is owned equally by Val

Q123: Super Sadie, Incorporated, manufactures sandals and distributes