Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,400. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

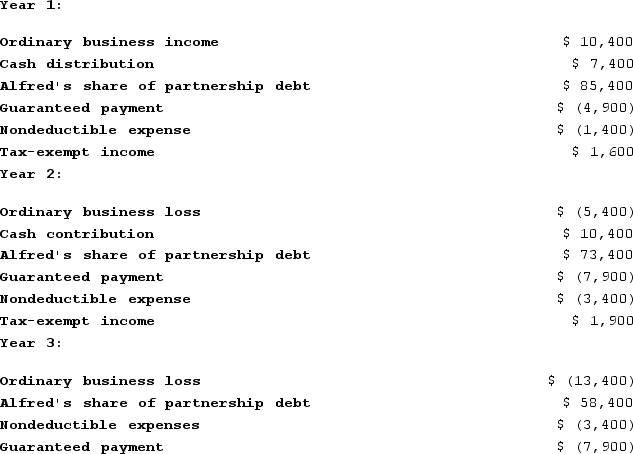

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Interest Expense

The cost incurred by an entity for borrowed funds.

Capital Structure

The composition of a company's funding, including debt, equity, and other financial instruments, which defines how a company finances its overall operations and growth.

Debt

Money that is owed or due to be paid, typically resulting from borrowing funds to be repaid with interest.

Financial Leverage

Financial leverage is the use of borrowed money (debt) to amplify the potential returns from an investment or project.

Q14: Pine Creek Company is owned equally by

Q17: Which of the following stock distributions would

Q58: The payroll factor includes payments to independent

Q62: A partner that receives cash in an

Q75: Terrapin Corporation incurs federal income taxes of

Q81: An S corporation shareholder's allocable share of

Q82: Sparrow Corporation reported pretax book income of

Q89: Gary and Laura decided to liquidate their

Q112: Inventory is substantially appreciated if the fair

Q113: Roxy operates a dress shop in Arlington,