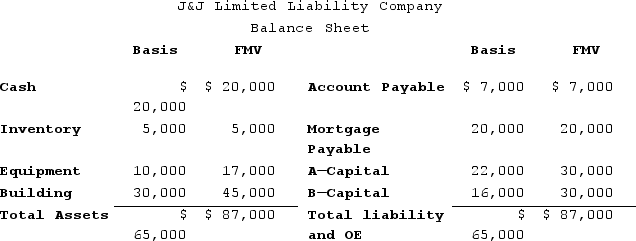

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Burnout

A state of physical, emotional, and mental exhaustion caused by prolonged and intense stress, often resulting from the workplace environment.

Unrealistic Goals

Objectives that are not feasible or practical to achieve due to their overly ambitious, vague, or impractical nature.

Occupational Health and Safety Regulations

Laws and guidelines designed to ensure the physical and mental well-being of employees in the workplace.

Employer Noncompliance

Refers to the failure of employers to adhere to legal, regulatory, or policy requirements.

Q36: Lefty provides demolition services in several southern

Q43: Mighty Manny, Incorporated manufactures ice scrapers and

Q48: Cash distributions include decreases in a partner's

Q54: Clampett, Incorporated, has been an S corporation

Q57: Which of the following statements best describes

Q76: On April 18, 20X8, Robert sold his

Q80: The substitution effect:<br>A)predicts that taxpayers will work

Q80: In a tax-deferred transaction, the calculation of

Q90: A partnership may use the cash method

Q104: Phillip incorporated his sole proprietorship by transferring