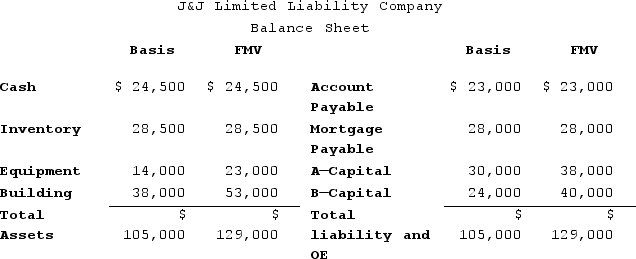

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Communicate

The act or process of using words, sounds, signs, or behaviors to express or exchange information or to express your ideas, thoughts, feelings, etc., to someone else.

Interactive Process

A dynamic method of engagement where input from multiple sources is considered, and actions are based on this collaborative communication.

Vision

A strategic guide that articulates desired goals and outlines how an organization intends to achieve its overall aspirations.

Strategy

A plan of action designed to achieve a long-term or overall aim.

Q4: Suppose that at the beginning of 2020

Q19: Grand River Corporation reported taxable income of

Q31: Mighty Manny, Incorporated manufactures ice scrapers and

Q32: Which requirement must be satisfied in order

Q34: Clampett, Incorporated, has been an S corporation

Q49: Roberta transfers property with a tax basis

Q73: Tyson, a one-quarter partner in the TF

Q88: Businesses must collect sales tax only in

Q107: Kristen and Harrison are equal partners in

Q133: Curtis invests $250,000 in a city of