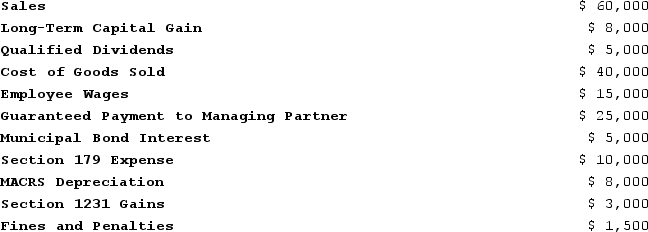

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Definitions:

Traditional Values

Norms and moral codes handed down through generations, often emphasizing family, religious beliefs, and cultural continuity.

Battered Woman

A woman who has experienced physical, emotional, or psychological abuse, typically in a domestic setting.

Cyclical

Pertaining to or occurring in cycles; often used to describe processes that repeat or recur in a predictable pattern.

Provoked

Stimulated or incited to some action or reaction, often resulting from a specific cause or stimulus.

Q36: Which of the following represents the largest

Q48: Which of the following statements is true?<br>A)In

Q68: If a taxpayer sells a passive activity

Q70: During 2020, CDE Corporation (an S corporation

Q79: Moss Incorporated is a Washington corporation. It

Q80: Corona Company is owned equally by Maria,

Q86: Locke is a 50percent partner in the

Q89: Which of the following statements regarding disproportionate

Q113: Sunapee Corporation reported taxable income of $720,000

Q118: Sam owns 65 percent of the stock