Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,400. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

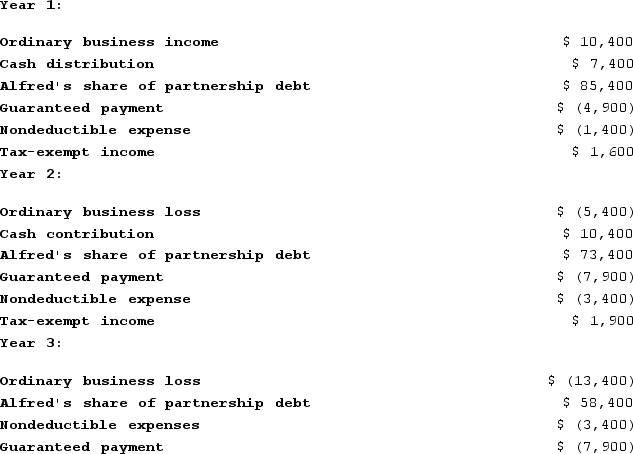

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Organizational Behavior

The study of how people interact within groups in a work setting, including the analysis of organizational structures and cultures.

Conducted

The action of organizing and carrying out certain activities, experiments, or studies systematically.

Strengths-Based Approach

A strategy in personal and professional development that focuses on individuals' strengths and talents instead of weaknesses.

Positive Perspective

The practice of looking at situations or events in a positive light, focusing on the good aspects rather than the bad.

Q3: Which of the following is a requirement

Q8: Katarina transferred her 10 percent interest to

Q42: Elk Company reports a deficit in current

Q45: ER General Partnership, a medical supplies business,

Q49: Roberta transfers property with a tax basis

Q52: Suppose a calendar-year C corporation, NewCorp, Incorporated,

Q55: Potter, Incorporated reported pretax book income of

Q59: XYZ Corporation (an S corporation)is owned by

Q70: Which of the following items would likely

Q110: On January 1, X9, Gerald received his