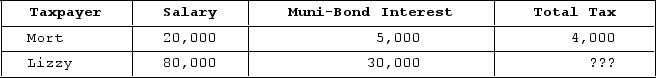

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Hallucination

A perception of having seen, heard, touched, tasted, or smelled something that isn't actually there.

Blood Clotting

The process where blood changes from a liquid to a gel, forming a clot to prevent excessive bleeding.

Cognitive Therapist

A mental health professional specializing in the treatment of mental disorders by changing negative patterns of thought.

Psychodynamically Oriented

Relating to an approach in psychology that emphasizes systematic study of psychological forces that underlie human behavior, feelings, and emotions and how they might relate to early experiences.

Q18: Knollcrest Corporation has a cumulative book loss

Q27: Carlos transfers property with a tax basis

Q33: Brown Corporation reports $100,000 of gain from

Q37: Riley is a 50percent partner in the

Q51: Davison Company determined that the book basis

Q71: Grand River Corporation reported taxable income of

Q71: Tax-exempt interest from municipal bonds is an

Q80: In a tax-deferred transaction, the calculation of

Q90: Beaver Company reports current E&P of $100,000

Q116: For tax purposes, companies using nonqualified stock