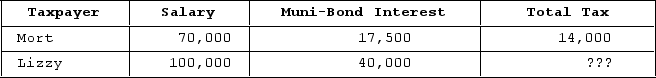

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Q18: Which of the following forms of earnings

Q26: Barry has a basis in his partnership

Q41: Catamount Company had current and accumulated E&P

Q47: Coop Incorporated owns 36 percent of Chicken

Q54: Clampett, Incorporated, has been an S corporation

Q61: XYZ, LLC, has several individual and corporate

Q86: Which of the following items will affect

Q90: In the sale of a partnership interest,

Q100: The dividends received deduction is subject to

Q123: The main difficulty in calculating an income