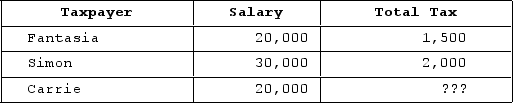

Given the following tax structure, what amount of tax would need to be assessed on Carrie to make the tax horizontally equitable? What is the minimum tax that Simon should pay to make the tax structure vertically equitable based on Fantasia's tax rate? This would result in what type of tax rate structure?

Definitions:

Mexican-Americans

A demographic group in the United States with cultural, ancestral, or nationality ties to Mexico.

Mental Disorder

A mental disorder is a condition characterized by significant disturbance in an individual's cognition, emotional regulation, or behavior, usually associated with distress or impaired functioning.

Immigrated

The act of leaving one's country of birth to live permanently in another country.

Generalized Anxiety Disorder

A mental health disorder characterized by excessive, uncontrollable worry about various aspects of life, often accompanied by physical symptoms.

Q2: Big-gain Corporation distributes land with a fair

Q10: Farm Corporation reported pretax book loss of

Q12: A corporation may carry a net capital

Q25: If the partnership has hot assets at

Q46: Which of the following taxes represents the

Q96: Which of the following statements best describes

Q103: Daniel acquires a 30percent interest in the

Q109: April transferred 100 percent of her stock

Q110: The "family attribution" rules are automatically waived

Q116: Rachelle transfers property with a tax basis