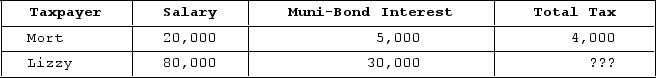

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Price Of Coffee

The market value or cost at which coffee is bought and sold, influenced by factors including production costs, demand, and supply conditions.

Income Decreased

A decrease in income refers to a reduction in the amount of money earned or received by individuals or entities over a period.

Political Science

The study of governments, public policies, political processes, political behavior, and ideas about governance and power.

Economics

The study within social science focused on examining how various entities including individuals, governments, businesses, and countries decide on the best way to distribute finite resources to meet their boundless needs.

Q12: The recipient of a tax-free stock distribution

Q24: Although a corporation may report a temporary

Q36: Scott is a 50percent partner in the

Q41: Implicit taxes are indirect taxes on tax-favored

Q41: Jenny has a $54,000 basis in her

Q46: Which of the following taxes represents the

Q55: Nadine Fimple is a one-half partner in

Q82: In January 2019, Khors Company issued nonqualified

Q91: Marc, a single taxpayer, earns $61,400 in

Q130: Which of the following statements regarding capital