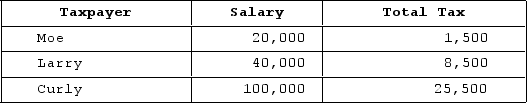

Consider the following tax rate structure. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Past Consideration

Something of value that has been given or promised in the past and cannot serve as consideration for a current contract due to its occurrence before the contract was made.

Present Promise

A vow or commitment to take action or uphold terms at the current time.

Moral Obligation

A duty or responsibility that is perceived as ethically required, even though it is not legally enforceable.

Requirements Contract

A contractual agreement in which one party agrees to supply as much of a product or service as the other party needs during a specified period.

Q20: TarHeel Corporation reported pretax book income of

Q27: El Toro Corporation declared a common stock

Q38: Which of the following statements best describes

Q53: Leonardo, who is married but files separately,

Q68: A calendar-year corporation has positive current E&P

Q84: Tax considerationsshould always be the primary reason

Q94: Smith Company reported pretax book income of

Q102: The effective tax rate, in general, provides

Q108: On January 1, 20X9, Mr. Blue and

Q120: S corporations are required to file Form