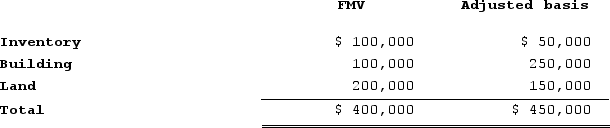

Phillip incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The fair market value of the corporation's stock received in the exchange was $400,000. The transaction met the requirements to be tax-deferred under §351.

The fair market value of the corporation's stock received in the exchange was $400,000. The transaction met the requirements to be tax-deferred under §351.

a. What amount of net gain or loss does Phillip realize on the transfer of the property to his corporation?

b. What amount of gain or loss does Phillip recognize on the transfer of the property to his corporation?

c. What is the corporation's adjusted basis in each of the assets received in the exchange?

Definitions:

Return On Investment

A metric utilized to assess the effectiveness or return on investment (ROI) or to compare the performance of various investments.

Interest Expense

The cost incurred by an entity for borrowing funds, typically calculated as a percentage of the principal loan amount.

Segment Performance

An evaluation of the results of a particular business segment's operations, often used to assess its profitability and efficiency.

Margin

A financial metric indicating the percentage of revenue that remains after subtracting the cost of goods sold; a measure of profitability.

Q3: Curtis invests $250,000 in a city of

Q14: Ruby's tax basis in her partnership interest

Q20: TarHeel Corporation reported pretax book income of

Q24: Rodger owns 100 percent of the shares

Q25: Jonah, a single taxpayer, earns $150,000 in

Q50: WFO Corporation has gross receipts according to

Q61: George recently paid $50 to renew his

Q62: One benefit of a sin tax (e.g.,

Q68: Which of the following statements regarding book-tax

Q108: On January 1, 20X9, Mr. Blue and