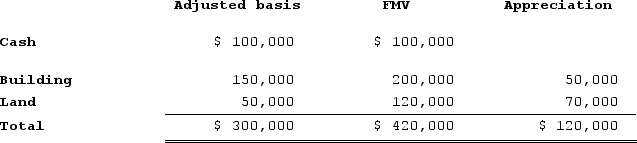

Gary and Laura decided to liquidate their jointly owned corporation, Amelia, Incorporated. After liquidating its remaining inventory and paying off its remaining liabilities, Amelia had the following tax accounting balance sheet.

Under the terms of the agreement, Gary will receive the $100,000 cash in exchange for his interest in Amelia. Gary's tax basis in his Amelia stock is $30,000. Laura will receive the building and land in exchange for her interest in Amelia. Laura's tax basis in her Amelia stock is $60,000.

Under the terms of the agreement, Gary will receive the $100,000 cash in exchange for his interest in Amelia. Gary's tax basis in his Amelia stock is $30,000. Laura will receive the building and land in exchange for her interest in Amelia. Laura's tax basis in her Amelia stock is $60,000.

What amount of gain or loss does Amelia recognize in the complete liquidation?

Definitions:

Age Of Majority

The legal age at which an individual is considered an adult and can engage in activities such as voting and signing contracts.

Entered Into

Refers to the act of formally agreeing to or engaging in an agreement, contract, or arrangement.

Emancipation

The legal process allowing a minor to gain independence from their parents or guardians, assuming adult responsibilities.

Legal Guardians

Individuals or entities appointed by a court to care for and manage the personal and/or property interests of a minor or legally incapacitated person.

Q9: A partner's tax basis or at-risk amount

Q20: The dividends received deduction is designed to

Q36: Which of the following represents the largest

Q42: Owners who work for entities taxed as

Q53: Which of the following statements best describes

Q57: Packard Corporation reported taxable income of $1,000,000

Q60: Which of the following would not be

Q62: MAC, Incorporated, completed its first year of

Q85: Only taxable income and deductible expenses are

Q108: Red Blossom Corporation transferred its 40 percent