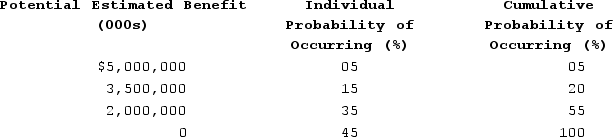

Acai Corporation determined that $5,000,000 of its R&D credit on its current-year tax return was uncertain. Acai determined that there was a 40 percent chance of the credit being sustained on audit. Management made the following assessment of the company's potential tax benefit from the R&D credit and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Definitions:

Lineal Descendants

Direct blood relatives in the direct line of descent, such as children, grandchildren, and great-grandchildren.

Issue

Can denote a problem, question, or matter that is in dispute or needs to be resolved.

Right of Survivorship

A legal principle that ensures property ownership transfer directly to a surviving co-owner or partner without the need for probate upon one's death.

Property Distribution

The division of assets, often occurring in legal contexts such as divorce or estate settlement.

Q8: Patricia purchased a home on January 1,

Q9: Zhao incorporated her sole proprietorship by transferring

Q35: Robin transferred her 60 percent interest to

Q50: Junior earns $80,000 taxable income as a

Q55: Lisa, age 45, needed some cash so

Q68: ASC 740 requires a publicly traded company

Q76: Ozark Corporation reported taxable income of $500,000

Q93: Milton and Rocco are having a heated

Q127: Al believes that SUVs have negative social

Q128: Relative to explicit taxes, implicit taxes are