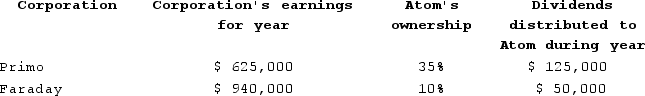

Atom Ventures Incorporated (AV)owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Definitions:

Failure Rate

Failure rate is the frequency at which an engineered system or component fails, expressed in failures per unit of time. It is often used in reliability engineering to determine a system's performance.

U.S. Managers

A term referring to individuals who occupy managerial positions within organizations in the United States, overseeing operations, planning strategies, and managing employees.

Spouse Adjustment

The process by which the partner of a relocated or expatriated employee adapts to the new living and cultural conditions in the host country.

Cross-Cultural Training

Educational programs designed to help individuals understand and appreciate cultural differences and improve interactions in a global or multicultural context.

Q9: Comet Company is owned equally by Pat

Q19: Grand River Corporation reported taxable income of

Q28: LLC <!--Markup Copied from Habitat--> members have

Q52: Crescent Corporation is owned equally by George

Q61: Jazz Corporation owns 10 percent of the

Q71: Grand River Corporation reported taxable income of

Q79: If an individual forms a sole proprietorship,

Q88: Up to $10,000 of dependent care expenses

Q91: Remsco has taxable income of $60,000 and

Q119: Which of the following statements best describes