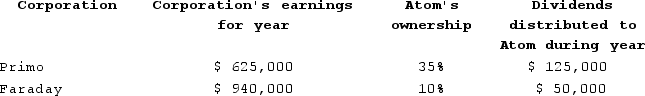

Atom Ventures Incorporated (AV)owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Definitions:

Q31: Which of the following statements regarding charitable

Q40: Which of the following items is not

Q51: Davison Company determined that the book basis

Q67: Rachelle transfers property with a tax basis

Q68: Losses from C corporations are never available

Q72: In 2020, US Sys Corporation received $269,000

Q78: Raja received 20 NQOs (each option gives

Q97: Kathy is 60 years of age and

Q107: In a given year, Adams Corporation has

Q108: Which of the following statements regarding Roth