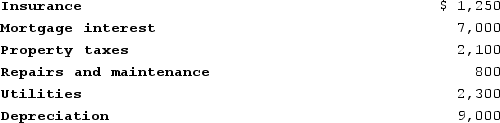

Rayleen owns a condominium near Orlando, Florida. This year, she incurs the following expenses in connection with her condo:

During the year, Rayleen rented the condo for 130 days and she received $25,000 of rental receipts. She did not use the condo at all for personal purposes during the year. Rayleen is considered to be an active participant in the property. Rayleen's AGI from all sources other than the rental property is $130,000. Rayleen does not have passive income from any other sources. What is Rayleen's AGI after accounting for the rental property?

During the year, Rayleen rented the condo for 130 days and she received $25,000 of rental receipts. She did not use the condo at all for personal purposes during the year. Rayleen is considered to be an active participant in the property. Rayleen's AGI from all sources other than the rental property is $130,000. Rayleen does not have passive income from any other sources. What is Rayleen's AGI after accounting for the rental property?

Definitions:

Ethical Dilemma

A situation in which a decision must be made between two or more morally correct actions that are in conflict.

Discrimination

Unfair treatment of individuals based on their membership in certain groups, such as race, gender, or age.

Plant Supervisor Position

A role responsible for overseeing and coordinating daily operations at a manufacturing or industrial plant.

Ethical Dilemma

A situation in which a difficult choice has to be made between two or more options, none of which resolves the situation in an ethically satisfactory way.

Q9: Tatia, age 38, has made deductible contributions

Q15: Yellowstone Corporation made a distribution of $300,000

Q37: Which of the following statements regarding the

Q42: Which of the following regarding Schedule M-1

Q56: Manchester Corporation recorded the following deferred tax

Q58: On April 1, year 1, Mary borrowed

Q73: On which tax form does a single-member

Q93: Clay LLC placed in service machinery and

Q105: Stock options will always provide employees with

Q117: Coop Incorporated owns 40percent of Chicken Incorporated.