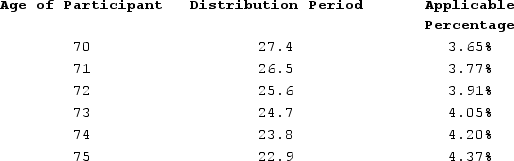

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,750,000. In 2020, Sean received a distribution of $50,000 from his 401(k)account (not a coronavirus-related distribution). Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining therequired minimum distribution penalty, if any).

Definitions:

Diagnosing Disorders

The process of identifying and classifying individual's behavioral, emotional, or cognitive dysfunctions into specific disorders based on established criteria.

Maladaptive Personality Traits

Characteristics within an individual that are detrimental to their ability to adapt and function effectively in various social, personal, or professional scenarios.

Borderline Personality Disorder

A mental health condition marked by unstable moods, behavior, and relationships, often stemming from a fear of abandonment.

Dialectical Behavioral Therapy

A type of cognitive-behavioral therapy that emphasizes the psychosocial aspects of treatment, focusing on the importance of a therapeutic relationship, acceptance, and understanding.

Q2: Patin Corporation began business on September 23

Q34: Kathy is 48 years of age and

Q61: Owners of which of the following entity

Q61: Jazz Corporation owns 10 percent of the

Q74: The rules for consolidated reporting for financial

Q81: If certain conditions are met, an apartment

Q83: Leesburg sold a machine for $2,200 on

Q87: Deirdre's business purchased two assets during the

Q90: Lebron Taylor purchased a home on July

Q97: Kathy is 60 years of age and