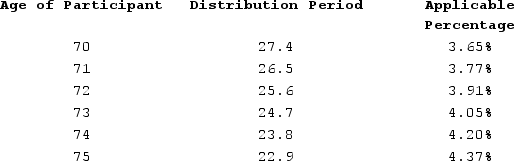

Sean (age 72 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,760,000 and the balance in his account on December 31, 2020, was $1,825,000. In 2020, Sean received a distribution of $65,000 from his 401(k)account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $65,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining the required minimum distribution penalty, if any).

Definitions:

Grief

Grief is the intense emotional suffering or distress experienced as a result of loss, particularly the death of a loved one.

Caregivers

Individuals who provide care and assistance to those in need, such as children, the elderly, or the sick.

Racial

Pertaining to race or ethnicity, often used in the context of discussing diversity, ethnicity, and social dynamics.

Ethnic Groups

Collections of individuals who share common cultural, linguistic, or ancestral traits, distinguishing them from other groups.

Q5: The method for tax amortization is always

Q10: The manner in which a business amortizes

Q29: If tangible personal property is depreciated using

Q31: Kristi had a business building destroyed in

Q45: If a corporation's cash charitable contributions exceed

Q73: For a like-kind exchange, realized gain is

Q80: For tax purposes, sole proprietorships pay sole

Q84: Corporations are not allowed to deduct charitable

Q86: Heidi retired from GE (her employer)at age

Q124: Paulman incurred $66,000 of research and experimental