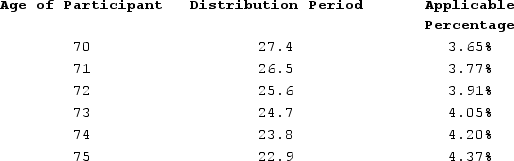

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,750,000. In 2020, Sean received a distribution of $50,000 from his 401(k)account (not a coronavirus-related distribution). Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining therequired minimum distribution penalty, if any).

Definitions:

Allergy

A condition in which the immune system reacts abnormally to a foreign substance, causing adverse effects.

Slight Muscle Aches

Slight Muscle Aches refer to minor or mild discomfort, soreness, or pain in the muscles, often resulting from physical exertion or tension.

Chronic Obstructive Pulmonary Disease

A progressive lung disease that makes it hard to breathe due to obstruction of the airways.

Digestive

Related to the process by which the body breaks down food into absorbable nutrients.

Q1: Manchester Corporation recorded the following deferred tax

Q10: Tatoo Incorporated reported a net capital loss

Q40: The C corporation tax rate is lower

Q45: Sadie sold 10 shares of stock to

Q63: Odintz traded land for land. Odintz originally

Q78: Potomac LLC purchased an automobile for $31,800

Q89: Frost Corporation reported pretax book income of

Q99: DeWitt Corporation reported pretax book income of

Q106: Crouch LLC placed in service on May

Q130: Lisa, age 45, needed some cash so